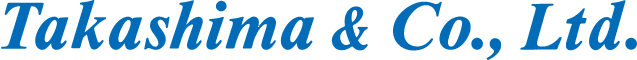

Medium-term Management "Sustainability V(Value)"

(FY2023 - FY2025)

Goals of "Sustainability V(Value)"

The aim of “Sustainability V (Value)” is for the Group to adapt to a sustainable society while simultaneously achieving sustainable growth, which it will accomplish by creating value through the formulation of a strategy to take advantage of growth opportunities in markets as they change in response to the Japanese government’s goal of realizing carbon neutrality by 2050.

(EN).png)

Basic Policy of “Sustainability V (Value)”

The medium-term management plan “Sustainability V” that began in April 2023 is based on the five basic policies to which we committed in the plan for meeting the continued-listing criteria, while also clarifying growth investment and other strategies.

Positioning of “Sustainability V (Value)”

“Sustainability V” further refines the strategic fields set out in “Sustainability X” for which we will provide functions, with the aim of creating new value for the shift to energy savings and labor savings.

Our goal is to achieve sustainable growth by formulating strategies that take advantage of the growth opportunities that arise from energy-saving needs against the background of issues associated with energy consumption and from emerging market needs for labor savings.

Under “Sustainability V,” we seek to enhance margins through business portfolio management that takes the growth potential and profitability of markets into account, and thus achieve profit growth.

At the same time, we have increased the investment limit to ¥15.0 billion, and by taking an active approach to investments and implementing shareholder returns that take capital efficiency into consideration, we aim to improve capital productivity and enhance corporate value.

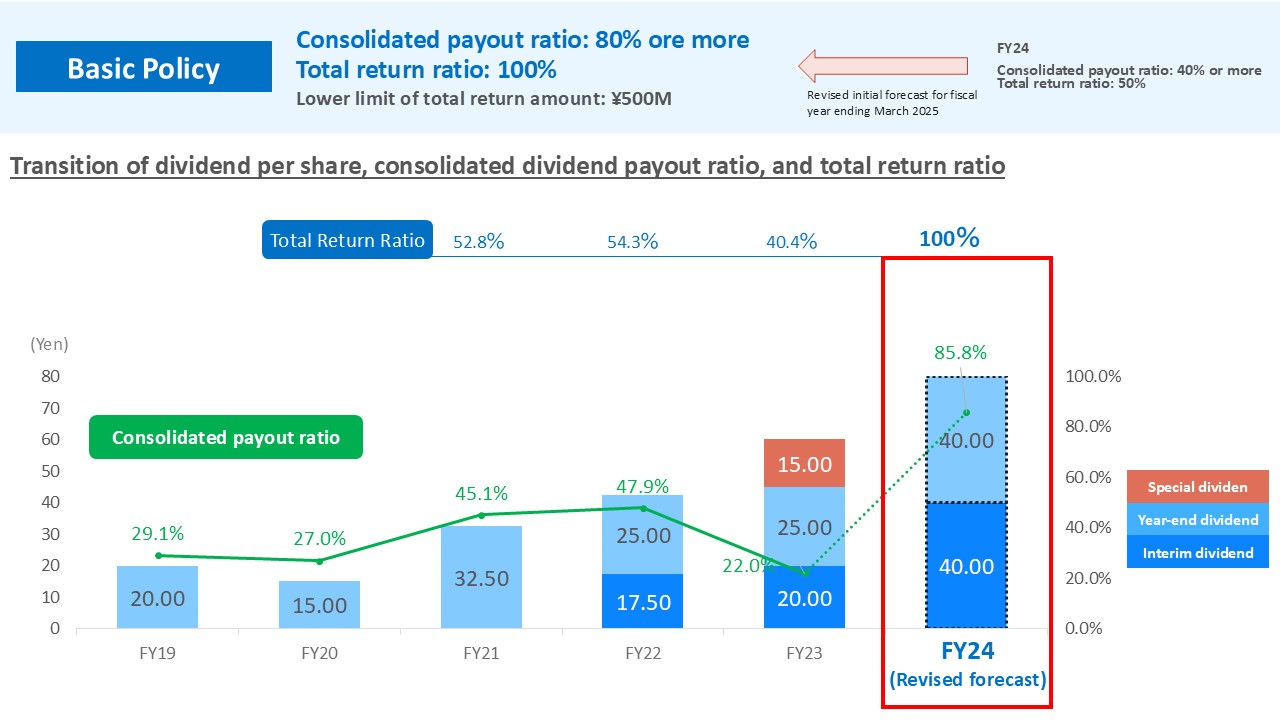

Shareholder Returns

Our basic policy on shareholder returns is to expand growth investments with the aim of becoming a “sustainable growth company with strategic investments,” while at the same time implementing shareholder returns with an awareness of capital efficiency.

Specifically, we aimed to pay a consolidated dividend payout ratio of 40% or more each fiscal year and a total return ratio of 50%.

This time, the target has been changed in recognition of the need to further improve capital efficiency in order to achieve a ROE of 8 percent or more. As a limited measure for the two years until the final year of Sustainability V (Value), we have changed the dividend payout ratio to a minimum of 80 percent and the total return ratio to 100 percent.

The data and future projections disclosed in this material are based on judgments and information available as of the date of publication of this material, and are subject to change for various reasons, including changes in economic conditions and market trends. Accordingly, there can be no assurances that the goals and forecasts stated in this document will be achieved or that future performance will be achieved.