In our medium-term management plan "Sustainability V (Value)" (FY2024 to FY2026), we have set a basic policy of achieving profit growth and improved capital productivity to improve our corporate value. In addition to the consolidated KPIs of 110 billion yen in sales, 2.6 billion yen in operating profit, and 1.9 billion yen in net profit attributable to owners of the parent for the fiscal year ending March 2026, we have set ROE of 8% or more and ROIC of 6% or more as capital return indicators.

We also set shareholder's equity cost and WACC (weighted average cost of capital) as capital costs to evaluate and verify the achievement of capital return. Regarding our stock price, we strive to ensure that our growth potential is properly and sufficiently evaluated by the market by actively engaging in dialogue with shareholders and investors, communicating our medium- to long-term growth strategy, and further enhancing disclosure information.

The Company has set a capital efficiency target for the fiscal year ending March 31, 2026 (FY2025), and has also indicated its policy to increase capital efficiency and growth-oriented investments and shareholder returns based on its capital allocation policy, and is committed to management with a strong awareness of the cost of capital and stock price.

Achieving profit growth and improving capital efficiency to increase corporate value

|

Profit Growth |

Improvement of Profitability |

◼ Pursuing a strategy of providing multiple values by seizing growth opportunities in the market and gradually improving profit margins over the medium- to long-term span. ◼ Improve the profit foundation by concentrating management resources on areas that will earn high profits over the medium-term span |

|

Growth in Net Sales |

◼ Accelerate investment in strategic domains and grow sales |

|

|

Investment in Human Assets |

◼ Formulate and implement medium- to long-term human assets management strategies -Visualization of the Group's human assets -Recruitment and human assets development initiatives for management human assets (career-type human assets), global human assets, sales human assets, and highly specialized human assets -Measures to improve employee engagement |

|

|

Capital Productivity Improvement |

Business Investment and Capital Investment |

◼ Allocation of capital to growth investments: Investment limit set to over ¥10 billion. ◼ Aggressive investment with an awareness of capital efficiency, including total asset turnover and financial leverage (utilization of interest-bearing debt) |

|

Shareholder Return |

◼ Shareholder return policy taking capital efficiency into account (total return ratio: 50%) ◼ Focus on building relationships with institutional investors and strengthening information disclosure through various IR tools |

|

FY2023 |

FY2024 |

FY2025 Important target index*1 |

|

|

Net sales |

¥90.1 Bn |

¥94.5 Bn |

¥110.0 Bn |

|

Construction Supply |

¥58.1 Bn |

¥61.0 Bn |

¥70.0 Bn |

|

Industrial Materials |

¥17.1 Bn |

¥17.9 Bn |

¥20.0 Bn |

|

Electronic Devices |

¥14.7 Bn |

¥15.5 Bn |

¥20.0 Bn |

|

Operating profit |

¥1.74 Bn |

¥2.12 Bn |

¥2.6 Bn |

|

Profit attributable to owners of parent |

¥4.83 Bn |

¥1.56 Bn |

¥1.9 Bn |

|

ROE |

22.4% |

6.6% |

Over 8% |

|

ROIC |

4.2% |

4.4% |

Over 6% |

|

Total return ratio |

40.4% |

100.2% |

100%*2 |

|

Investment quota |

¥9.8 Bn*3 |

¥13.7 Bn*4 |

¥15.0 Bn*5 |

*1 Updated Medium-term Management Plan Sustainability V (Value) FY2023 to FY2025 (announced on December 14, 2023)

*2 Changes to shareholder return policy in the Medium-term Management Plan Sustainability V (Value) (announced on August 8, 2024)

*3 Cumulative total from FY2021 to FY2023

*4 Cumulative total from FY2021 to FY2024

*5 Cumulative total from FY2021 to FY2025

|

FY2023 |

FY2024 |

|

|

◇Profit |

In view of capital efficiency, real estate for rent, investment securities, etc. were sold. Profit attributable to owners of parent 204.8 % YoY. |

Decrease due to gains from sales of real estate for rent, etc., in the previous fiscal year. Profit attributable to owners of parent decreased 67.6% YoY. |

|

◇ ROE |

ROE increased 14.1% points YoY due to higher profit attributable to owners of parent and increased financial leverage. ROE significantly exceeded cost of equity. (Equity Spread 16.7%) |

ROE decreased 15.8% points compared to the previous fiscal year due to the impact of gains on sales of real estate for rent, etc., which occurred in the previous fiscal year. ROE exceeded the cost of shareholders' equity. (Equity Spread 1.6%) |

|

◇ ROIC |

ROIC declined by 0.8% YoY as a result of the expansion of invested capital due to the significant increase in net profit attributable to owners of parent from the previous year. ROIC is below WACC.(EVA spread -0.3%) WACC increased due to an increase in the Company's market capitalization and a higher ratio of shareholders' equity to interest-bearing debt. |

ROIC increased by 0.2% points compared to the previous period due to the increase in invested capital, but due to the increase in operating profit. ROIC exceeded WACC. (EVA spread 0.9%) |

*In FY2023, profit attributable to owners of parent, shareholders' equity, and ROE all increased significantly due to a gain on sales of fixed assets of 4,773 million yen, which was the result of executing a review of asset allocation through the sale of real estate.

Profit: Profit attributable to owners of parent (Millions of yen)

Net assets: average during the period (Millions of yen)

|

FY2020 |

FY2021 |

FY2022 |

FY2023 |

FY2024 |

|

|

ROE (%) |

5.9 |

7.2 |

8.3 |

22.4 |

6.6 |

|

Profit (Millions of yen) |

1,000 |

1,296 |

1,585 |

4,832 |

1,566 |

|

Net assets (Millions of yen) |

16,930 |

17,965 |

19,008 |

21,559 |

23,751 |

|

ROIC (%) |

5.1 |

5.2 |

5.0 |

4.2 |

4.4 |

|

Cost of equity (%) |

5.9 |

6.2 |

5.6 |

5.7 |

5.0 |

|

WACC (%) |

4.4 |

4.0 |

3.9 |

4.5 |

3.5 |

Profit: Profit attributable to owners of parent

Net assets: average during the period

-

As a result of steadily implementing initiatives based on the basic policy of the medium-term management plan, P/B Ratio has risen to almost 1.0x.

-

We recognize that there is still a gap between our current and market expected returns, so we will work on measures to grow profits and improve capital productivity.

|

FY2023 |

FY2024 |

|

|

◇ Market capitalization |

In the FY2023, our stock price has remained firm, and its market capitalization is on an upward trend as a result of a large upward revision of full-year final profits, an increase in dividends due to higher profits, and a large-scale stock buyback. |

|

|

◇ PBR |

P/B ratio is below the 1.0x level, recognizing that the situation has not reached the market's return expectations. |

|

|

FY2020 |

FY2021 |

FY2022 |

FY2023 |

FY2024 |

|

|

P/B ratio (times) |

0.46 |

0.55 |

0.67 |

0.94 |

0.93 |

|

ROE (%) |

5.9 |

7.2 |

8.3 |

22.4 |

6.6 |

|

P/E Ratio (times) |

8.0 |

7.8 |

8.2 |

4.6 |

14.0 |

|

Market capitalization (Millions of yen) |

8,011 |

10,122 |

12,998 |

22,078 |

22,283 |

|

Net assets (Millions of yen) |

17,454 |

18,477 |

19,539 |

23,578 |

23,924 |

- Achieve ROE target of 8.0% or more and ROIC target of 6.0% or more in the final year of the medium-term management plan (fiscal year ending March 31, 2026 (FY2025))

- Steadily implement initiatives based on the basic policies of the medium-term management plan to improve P/B ratio, and strive to increase corporate value through profit growth and capital productivity improvement

・PMI execution and monitoring

Accelerate the return on investment and raise Group profits through implementation and appropriate monitoring of PMI measures for the four main M&As implemented.

・New investment in strategic areas (M&A, new businesses, plant and equipment investment, etc.)

Expand investment limits and make new investments emphasizing capital efficiency and growth potential based on capital allocation policy

・Restructuring of Industrial Materials Segment

Improve the growth potential and capital profitability of the Industrial Materials business through consolidation of the Industrial Materials business as a subsidiary and reorganization of group companies.

・Achieving both growth and shareholder returns

Shareholder returns based on a consolidated dividend payout ratio of at least 80% and a policy of 100% total return ratio (including share buybacks and cancellations)

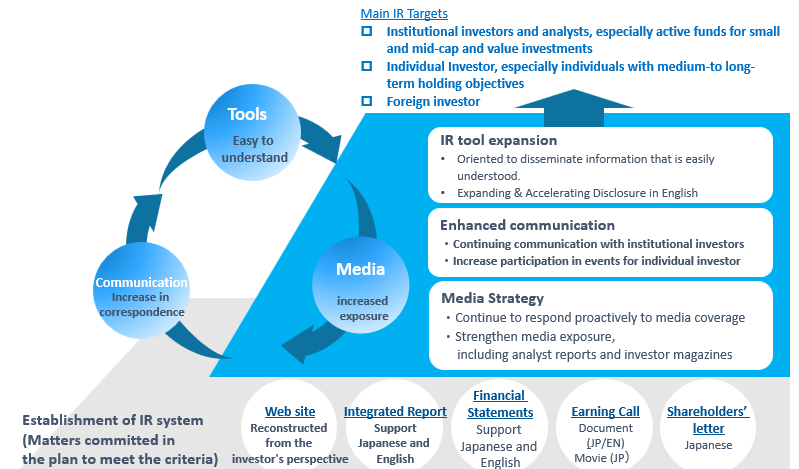

・Enhancement of various IR tools /Strengthen information disclosure to foreign investors and individual investors, and dialogue with shareholders

Expand opportunities for investor communication through participation in investor events and efforts to increase awareness through the use of mass media for investors

・Reduction of policy shareholdings

Reduction toward a net asset ratio of less than 10.0%.

Actual results during the period of the Strategic Investment Limit (FY2021-FY2025)

|

◇M&A (Including M&A in group companies) |

M&A

|

|

◇Capital and business partnership |

Advanced penetration of renewable energy through digital grid technology |

|

◇Human assets investment |

|

Strengthening Capabilities in the Solar Power Market through M&A

|

Our Group's Capabilities in the Photovoltaic Power Generation System Market |

Residential |

Distribution |

Takashima & Co., Ltd. |

|

Installation |

New Energy Distribution System Inc. |

||

|

Industrial |

Distribution |

Takashima & Co., Ltd. |

|

|

Installation |

Sanwa System Co., Ltd. |

Comprehensive Collaborative Agreement on Zero Carbon Island Okinoerabu Project

Kagoshima Prefecture, China Town - Erabuyuri Electric Power Co., Ltd - Takashima Co.

- Of the investment budget expanded to 15 billion yen, a cumulative total of 13.7 billion yen has been invested between fiscal 2021 and fiscal 2024.

- Continue to invest aggressively by actively utilizing external funds (interest-bearing debt, etc.) and cash from asset allocation.

|

FY2021 - FY2023 |

FY2024 |

Total |

|

|

M&A (Included M&A Consideration Costs) |

¥7.45 Bn |

¥3.13 Bn |

¥10.58 Bn |

|

|

||

|

Plant & equipment (Investment in maintenance, renewal and enhancement of own plants and facilities) |

¥1.44 Bn |

¥0.43 Bn |

¥1.87 Bn |

|

Human assets, IT & others (Recruit/Engagement Survey Core system renewal Enhancement of IR) |

¥0.95 Bn |

¥0.32 Bn |

¥1.26 Bn |

|

Invested ammount |

¥9.84 Bn |

¥3.87 Bn |

¥13.71 Bn |

basic policy on shareholder return

- Our basic policy on shareholder return is to increase investment in growth, aiming to become a company of sustainable growth with strategic investment, while at the same time, we will return profits to shareholders with an awareness of capital efficiency.

Medium-term Management Plan “Sustainability V(Value)

- Shareholder returns based on a consolidated dividend payout ratio of at least 80% and a 100% total return policy (including share repurchases and cancellations)

- based on the recognition that further improvement of capital efficiency is necessary to achieve ROE of 8% or higher, we have decided to change the shareholder return policy of a dividend payout ratio of 40% or higher and a total return ratio of 50%, which were previously set under Sustainability V (Value).

4-for-1 stock split of common stock effective October 1, 2023.

Dividend per share before the stock split is based on the assumption that the stock split was conducted in the fiscal year ended March 31, 2020 (FY2019).

- Expand opportunities for investor communication by exhibiting at investor events and using mass media for investors to raise awareness

Breakdown of the number of shares by investor type

(End of March 2025)

IR strategy

- FY2023: Sell all financial institution stocks (4 stocks)

- FY2024: Sell trading partner stocks (3 stocks). Cross-shareholdings to net assets ratio is 9.9%

|

Policy stock |

FY2020 |

FY2021 |

FY2022 |

FY2023 |

FY2024 |

|

|

Shares other than unlisted shares |

Number of Company |

18 |

18 |

18 |

14 |

11 |

|

Balance sheet amount (Millions of yen) |

2,936 |

2,697 |

2,462 |

2,629 |

1,883 |

|

|

Shares of unlisted shares |

Number of Company |

22 |

22 |

20 |

21 |

22 |

|

Balance sheet amount (Millions of yen) |

147 |

147 |

137 |

187 |

487 |

|