As a company, we are committed to maintaining appropriate relationships with our shareholders and other stakeholders and to fulfilling our social responsibilities as we exercise our business activities. We believe firmly that this is an important challenge in our pursuit of improving long-term performance and ensuring sustainable growth.

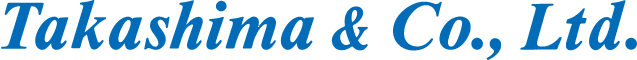

Enhancing our corporate governance and establishing highly transparent and fair management is a vital and fundamental duty of the company. To this end, Takashima is setting up and implementing a corporate governance system that serves to strengthen management oversight and monitoring functions—centered on our Board of Directors and Audit & Supervisory Committee—and also to address issues such as internal controls and risk management.

The Company has adopted a company-with-Audit and Supervisory committee system in order to utilize the functions of outside directors to strengthen the supervisory function of the Board of Directors and the corporate governance system, and to enhance the soundness and efficiency of management through prompt decision-making and business execution by delegating authority. Our corporate governance system consists of a Board of Directors, an Audit & Supervisory Committee. There are eight directors (including five Audit & Supervisory Committee members), five of whom are outside directors who are also Audit & Supervisory Committee members.

The Board of Directors meets every month and has the authority to make decisions on matters stipulated by law and regulations and on important matters related to management.

In principle, the Audit and Supervisory Committee meets monthly to manage progress by requesting reports from business executives on key audit items as appropriate, in addition to regular audit items.

The committee also conducts advance reviews of important agenda items at Board of Directors meetings in order to improve the quality and effectiveness of discussions.

The committee is chaired by a full-time outside director and consists of five members, including four part-time outside directors.

The committee members are from financial institutions, certified public accountants, lawyers (female), and individuals with management experience at other companies, ensuring sufficient diversity in their skills matrix.

The Nomination Committee is composed of five outside directors and one internal director, and is chaired by a full-time outside director, ensuring fair and objective deliberation. The committee reviews the suitability of directors and executive officers for appointment and dismissal through written and interview examinations, and reports the results to the Board of Directors.

The Remuneration Committee, which is composed of six outside directors and one internal director and chaired by a full-time outside director, conducts fair and objective deliberations. The committee discusses the executive compensation system and determines the amount of performance-based compensation based on business performance and the contribution to that performance, and reports the results to the Board of Directors.

The Management Committee meets at least once a month to ensure that the Board of Directors is thoroughly informed of decisions made by the Board of Directors and to consider major issues related to the execution of business operations. It is composed of all executive officers, and as necessary, the relevant persons are invited to attend and speak on matters to be deliberated. In addition, Audit Committee members attend and speak at the meetings as necessary.

The Compliance Committee, as an umbrella organization to promote compliance, is chaired by the President, vice-chaired by the Cheif of Business Management Divison, and consists of members appointed by the President. In principle, the committee meets once a year to deliberate on overall compliance issues and determine basic policies.

The Risk Management Committee is chaired by the Chief of Business Management Division and consists of members appointed the Chief of Business Management Division. The committee meets at least twice a year to identify and investigate risks stipulated in the regulations, and to consider measures to avoid risks before they occur, as well as measures to deal with risks that have materialized.

The Sustainability Committee, as an organization to promote sustainability, consists of the Chief Executive Officer and those who appointed by the President and Chief Executive Officer as its members. In principle, the committee meets at least twice a year to discuss issues related to sustainability set by the Chief Executive Officer and make recommendations to the Chief Executive Officer.

The Company has established the Internal Audit Department. This department investigates the status of the internal control system and the appropriateness of business execution, and provides guidance on improvements. The Audit & Supervisory Committee and the Internal Audit Department exchange opinions as necessary and work together to strengthen the auditing function. The Company employs KPMG AZSA LLC as its accounting auditor, and works closely with the Audit & Supervisory Committee and the Internal Audit Division to ensure the appropriateness of audits.

|

◎ indicates the chairperson or committee chairperson.

Please see below for the titles and brief career profiles of our directors.

The following is a skills matrix listing the areas in which our Board of Directors should be equipped (experience, knowledge, and abilities) and in which each director can demonstrate particular expertise. Note that outside directors include those with management experience at other companies.

|

Position |

Corporate Management |

Sales/Business Development |

Finance/M&A |

Marketing Planning/IR |

IT/ Digital |

Human Assets/Labor Management/ Organization Development |

Legal/ Risk Management/ Audit |

International Experience |

Manufacturing/ Technology/ R&D |

||

|

Koichi Takashima |

Male |

President and Representative Director, and Chief Executive Officer |

● |

● |

● |

● |

|||||

|

Toshio Goto |

Male |

Director, Senior Managing Executive Officer |

● |

● |

● |

● |

|||||

|

Akira Yamamoto |

Female |

Director, Senior Managing Executive Officer |

● |

● |

|||||||

|

Junko Kawai |

Male |

Outside Director |

● |

● |

|||||||

|

Akifumi Ujita |

Male |

Outside Director (Full time Audit and Supervisory Committee Member) |

● |

● |

● |

● |

|||||

|

Yuji Momosaki |

Male |

Outside Director (Audit and Supervisory Committee Member) |

● |

● |

● |

● |

● |

● |

|||

|

Ren Shino |

Female |

Outside Director (Audit and Supervisory Committee Member) |

● |

||||||||

|

Yasushi Aoki |

Male |

Outside Director (Audit and Supervisory Committee Member) |

● |

● |

● |

● |

|||||

|

Shuichi Sakamoto |

Male |

Outside Director (Audit and Supervisory Committee Member) |

● |

● |

● |

● |

● |

● |

● |

Corporate Management

As a trading company, the Company operates in a wide variety of fields. When discussing management plans and strategies, we believe that it is important to have a bird’s eye view of matters and to be equipped with critical knowledge for improving enterprise value.

Sales/Business Development

Sales and business development are essential for generating revenue. We believe that these skills are vital for presenting society with the original ideas that only Takashima can offer, maintaining our competitiveness as a company, and expanding our market share.

Finance/M&A

Finance and M&A are crucial for implementing strategies for maximizing enterprise value. Finance and M&A constitute the foundation that supports our sustainable growth and competitiveness.

Marketing/Planning/IR

We believe that communication with others is of paramount importance. Marketing, planning, and IR are key sources that help us maintain our competitiveness and achieve growth through constant communication with others.

IT/Digital

IT and digital technologies are tremendously important for businesses in the modern era. We believe that by leveraging IT and promoting digital transformation (DX), we can transform our business model and processes through the use of digital technologies and improve our competitiveness.

Human Assets/Labor Management/Organization Development

For a trading company like us, human assets are our greatest assets and are vital to our growth and sustainable success as a company. The foundation for our sustainable growth is our ability to improve enterprise value through the development of our unique career-type human assets.

Legal/Risk Management/Audit

Legal, risk management, and audit skills are essential to our ability to defend ourselves against external risks and malpractice. As a company whose motto is “Integrity,” we believe that these aspects are important for building relationships of trust with investors, business partners, and society

International Experience

Experiencing different cultures and environments can generate new ideas and perspectives that enhance a company’s competitiveness. Likewise, we believe that such experiences will enhance our ability to handle risks associated with different markets and cultures, thereby allowing us to evaluate these risks more accurately and address them more appropriately.

Manufacturing/Technology/R&D

As a value-adding trading company that provides a variety of functions, improving our product quality and efficiency is essential to maintaining our competitiveness. The elements of manufacturing, technology, and R&D are indispensable as we seek to establish our position in markets and achieve sustainable growth.

Our outside directors are outside directors as provided for in the Companies Act and the Enforcement Regulations of the Companies Act, and are elected on the condition that they do not fall under any of the following criteria.

(1) An executive director, executive officer, or employee (hereinafter referred to as "executive") of the Company or its affiliates, or a person who has been an executive of the Company or its affiliates in the 10 years prior to their appointment

(2) A major shareholder holding 5% or more of the total voting rights of the Company, or an executive of the Company or its affiliates if the shareholder is a corporation or organization

(3) A person who is an executive of a company that has a significant business relationship (including major business partners) with the Company or its affiliates, or of its parent company or its important subsidiaries

(4) A person who has received remuneration or other financial benefits of 10 million yen or more on average over the past three years, in addition to the remuneration for directors of the Company, as a lawyer, consultant, etc. of the Company or its affiliates. Or, if it is a corporation or organization, a person who is an executive officer of a corporation or organization whose consolidated sales revenue from the Company or its affiliates accounts for 2% or more of the said corporation or organization's consolidated sales.

(5) A person who is an accounting auditor of the Company or its affiliates, or an employee of the accounting auditor.

(6) A person who is an executive officer of a corporation or organization that has received donations, etc. from the Company or its affiliates in an average of 10 million yen per year for the past three years or more than 30% of the total annual expenses of the said corporation or organization, whichever is greater.

(7) A person who falls under any of (2) to (6) above in the past five years.

(8) A person whose spouse or a relative within the third degree of kinship falls under any of (1) to (6) above.

(9) A person who is an executive officer of a company that accepts a director from the Company or its affiliates, or its parent company or its subsidiaries.

(10) A person who has served as an outside director for a total of 10 years.

(11) A person who is at risk of having a constant and substantial conflict of interest with the Company's general shareholders as a whole for reasons other than those considered in (1) to (10) above.

Recognizing that selection of the Chief Executive Officer, which is the top management position, constitutes the most important of its decision-making matters, the Company accordingly has the Nominating Committee exchange opinions on an ongoing basis regarding prospective candidates for President and prospective management. The Company has accordingly established four criteria to be sought with respect to managers, as follows, in looking toward developing the next generation of management.

Ability to realize the corporate mission (Vision)

Progress × fit (Design)

Integrity

Ability to align the direction for the whole organization (Communication)

The Company applies the four criteria listed above to its Executive Officers and those in positions at or above Unit Manager, who is in charge of a unit, the Company’s smallest organizational entity. The Company accordingly calls for them to manage these entities under their leadership as if they were corporations. Meanwhile, those in positions at or above General Manager undergo 360-degree feedback once a year, which includes objective evaluation and feedback on the four criteria, with the aim of helping them improve their abilities in each criterion.

The Company conducted an evaluation of the Board of Directors effectiveness using a third-party organization in FY2016, and implemented self-evaluations of the Board based on the results of that evaluation. In the following fiscal years, the Audit and Supervisory Committee has conducted evaluations of the effectiveness of the Board of Directors, and the Board of Directors has held discussions on the evaluation results.

As a result of the analysis and evaluation this year, it has been determined that the Board of Directors has engaged in active discussions aimed at providing thorough supervision of business execution, and that its effectiveness has been largely ensured.

(Future issues and measures)

The following issues were identified as a result of this effectiveness evaluation. We will continue to work to improve the effectiveness of the Board of Directors by taking measures to address these issues.

- Increasing the number of female directors and training successors (composition of the board of directors)

- Extracting important discussion items and creating an annual schedule (operation of the board of directors)

- Improving training for directors (need to improve knowledge of executives)

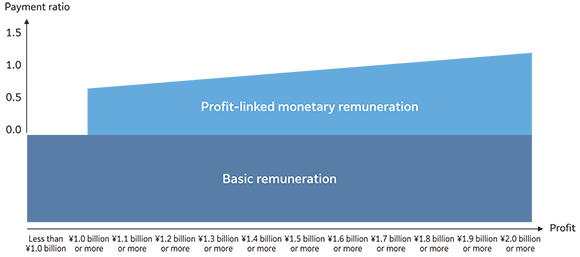

The remuneration for Directors and other officers of the Company is comprised of basic remuneration, profit-linked monetary remuneration, and share-based remuneration. Basic remuneration is set for individual Directors and other officers, taking into account their position, business performance, remuneration levels at other companies, remuneration levels of employees, etc., and is paid in a fixed monthly amount calculated by dividing the determined annual basic remuneration by 12.

Profit-linked monetary remuneration is paid to the Company’s eligible Directors (excluding Directors who are Audit and Supervisory Committee Members and outside Directors) if profit attributable to owners of parent is ¥1.0 billion or more after recording profit-linked monetary remuneration as an expense, and the amount to be paid to the President and Representative Director is calculated by multiplying profit attributable to owners of parent by a predetermined payment rate. Next, the amount to be paid to each of the other eligible Directors is calculated by multiplying the individual amount to be paid to the President and Representative Director by a predetermined coefficient for each position. The amount to be paid to each eligible Director is paid within one month from the date of the General Meeting of Shareholders. However, the maximum total amount to be paid is ¥100 million.

The remuneration for the Company’s Directors (excluding Audit and Supervisory Committee Members) is the total of the above basic remuneration and profit-linked monetary remuneration, and is ¥320 million or less per year.

Regarding share-based remuneration, the Company has introduced a restricted share-based remuneration plan in order to provide incentive to the Company’s eligible Directors to continuously enhance the corporate value of the Company and promote further sharing of value with shareholders. The amounts to be paid and the timing of payment are determined by the Board of Directors of the Company on the condition that the eligible Directors have continuously remained in a position specified by the Board of Directors. Restrictions on the transfer of shares are lifted immediately after the eligible Directors resign from the position specified by the Board of Directors of the Company. Separate from the above remuneration for Directors of ¥320 million or less per year, the amount to be paid is ¥60 million or less per year and the total number of common shares of the Company to be issued or disposed of is 96,000 shares or less per year.

Remuneration for President and Representative Director (excluding share-based remuneration)

Coefficients by position for profit-linked monetary remuneration

|

Position |

Coeffiicient |

|

Representative Director and Chairman |

0.9 |

|

President and Representative Director, and Chief Executive Officer |

1.0 |

|

Director and Executive Vice President |

0.8 |

|

Director and Senior Managing Executive Officer |

0.7 |

|

Director and Managing Executive Officer |

0.6 |

|

Director and Executive Officer |

0.4 |

We classify cross-shareholdings as follows: cross-shareholdings held solely for the purpose of obtaining profits from fluctuations in share value or dividends; and cross-shareholdings held for purposes other than cross-shareholdings (cross-shareholdings).

As of the end of fiscal year 2024, we are not holding any investment shares for pure investment purposes.

Methods for verifying holding policies and the rationality of holdings

Our policy is to hold cross-shareholdings held for purposes other than cross-shareholdings if it is determined that the continued holding of shares outside the group is strategically optimal for the operation, development, and sustainable growth of the business, and contributes to the improvement of corporate value in the medium to long term.

Contents of verification by the board of directors, etc. regarding the appropriateness of holding individual stocks

Verification of continued holdings involves verifying whether the purpose of holding each stock is appropriate, whether there is significance in continuing to hold it, and whether strategic significance is obtained by holding it. In addition, we will confirm whether the benefits derived from the shares (contribution to our profits, dividends received, etc.) exceed the capital cost as of the last day of the previous fiscal year. The above verification will be conducted once a year at a board of directors meeting and a comprehensive decision will be made on whether to continue holding the shares.

We have set a goal of reducing the net asset ratio of cross-shareholdings to less than 10.0% during the period of our medium-term management plan, SustainaV (Value).

As of the end of the FY 2024, it stands at 9.9%.